How Risk is Calculated by Insurance Companies

The question is how the insurance companies calculate their premiums and why their results differ so much. When we first look at the history of the insurance, groups of ship owners are seen together. They faced the problem of bankruptcy if their ship sunk or their cargo was lost.

They worked out a plan of sharing the risk between them by each agreeing to pay an amount of loss. If a there were 100 ship owners and the average loss for example was £10,000, they would each pay £100 over I year into the fund for covering the loss. It would be better to guarantee to lose £100 than risking losing an amount of £10,000.

Nowadays, insurance is a bit more difficult but the basic principles of risk sharing are still present. Those people who calculate risk behind the scene are known as underwriters and it’s their job to calculate who are most likely to claim.

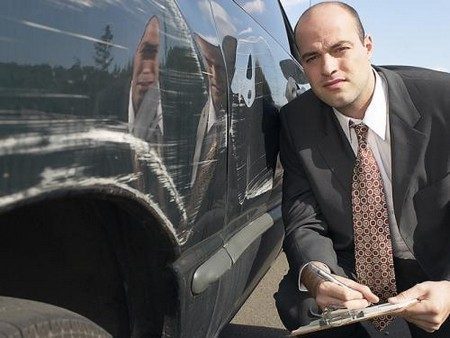

Each insurer considers at their own statistics of losses for calculating the future risk. The points taken into account are experience, age and use of vehicle. They will also inspect the area to determine the accident, theft rate and repair costs.

After that, an insurer will calculate their ideal risk rate, the driver offers them the most profitable amount and calculates a rate to take of each of these drivers. Most of the insurers deter what they perceive as bad risks with high premiums.

One factor is the amount paid by an insurer. If the insurer tries to cover up the work at the cost of cheap repairs and lower vehicle assessments they will be able to give low premiums. This is an important factor when choosing insurance and matches true with the saying of ‘you get what you pay for’

The Torque Cars recommend their members to get different quotations from variety of insurers. The broker and direct insurer have to be included and a price comparison site can be visited to check any offers. If there are special insurance requirements like business use or a modified car, then a specialist insurer will be needed and a broker has to be consulted.

Brokers normally charge a commission of 10% to 20% but they normally issue the policy documents from their office on the behalf of the insurer this compares favorably with administrative costs of direct insurers.

The broker can also give help if a claim is made. This can raise the insurer costs as they have to pay more and this is the reason why insurers prefer that they should be directly visited.

A good broker has the quality to negotiate special rates from an insurer and has the ability to put leverage on the insurer for providing a good service.

For getting cheaper insurance, an appealing risk has to be shown. A higher proportion of claim can be agreed to pay. An alarm can be fitted, advanced driving lessons can be taken, mileage or vehicle use should be limited.

After that, an insurer that has the best experience with driver group has to be selected. It should be remembered that cheaper is not always better, if a claim is made then the cutting corners may be regretted. Range of quotes has to be checked and too expensive and cheap has to be avoided.